Some things in life are just begging to be pushed to the end of my to-do list, not to be done until I’m absolutely forced to: filing my taxes, making the appointment to get my yearly skin check, calling maintenance to finally fix my finicky door lock—the list goes on, and for me, finally dipping my toe into investing always had a permanent spot on my to-do-eventually list.

To say I’ve always felt as if I didn’t have enough knowledge to even know where to begin investing is an understatement; I’ve always felt like I didn’t even know what I didn’t know—a notch below “absolutely clueless.” My journalism major ensured I learned absolutely nothing about finance in college, and it felt like—even at 24—I was so desperately behind the pack that it was too late for me to really get a grasp on the stock market.

This year got me to do the things I had been pushing aside because I was busy, and after weeks of writing “START INVESTING” at the top of my planner, I decided it wasn’t something I could push off anymore. Enter: Public.com. Public is an investing social network where investors can own fractional shares of stocks and ETFs, making the barrier to entry significantly lower than other investing platforms. They know that a significant reason why many don’t invest is due to a lack of financial literacy, so they aim to unlock the stock market to a wider range of people through the empowerment of a community where you can learn and grow.

It felt like Public was welcoming my non-experienced self with open arms. Their mission is to make the stock market inclusive and fun, two words that felt like the opposite of other website’s goals. They also incorporate a social media aspect, where members can share ideas and news in a feed with other investors. This meant that I would be able to learn and grow my confidence with the help of other, real people, not just stock experts that I would feel were talking down to me.

After years and years of putting it off, I can finally say that I, Madeline Galassi, am an investor. Here’s where I began, how it all went, and what I learned:

*The following is for educational purposes only and is not investment advice.

Where I began

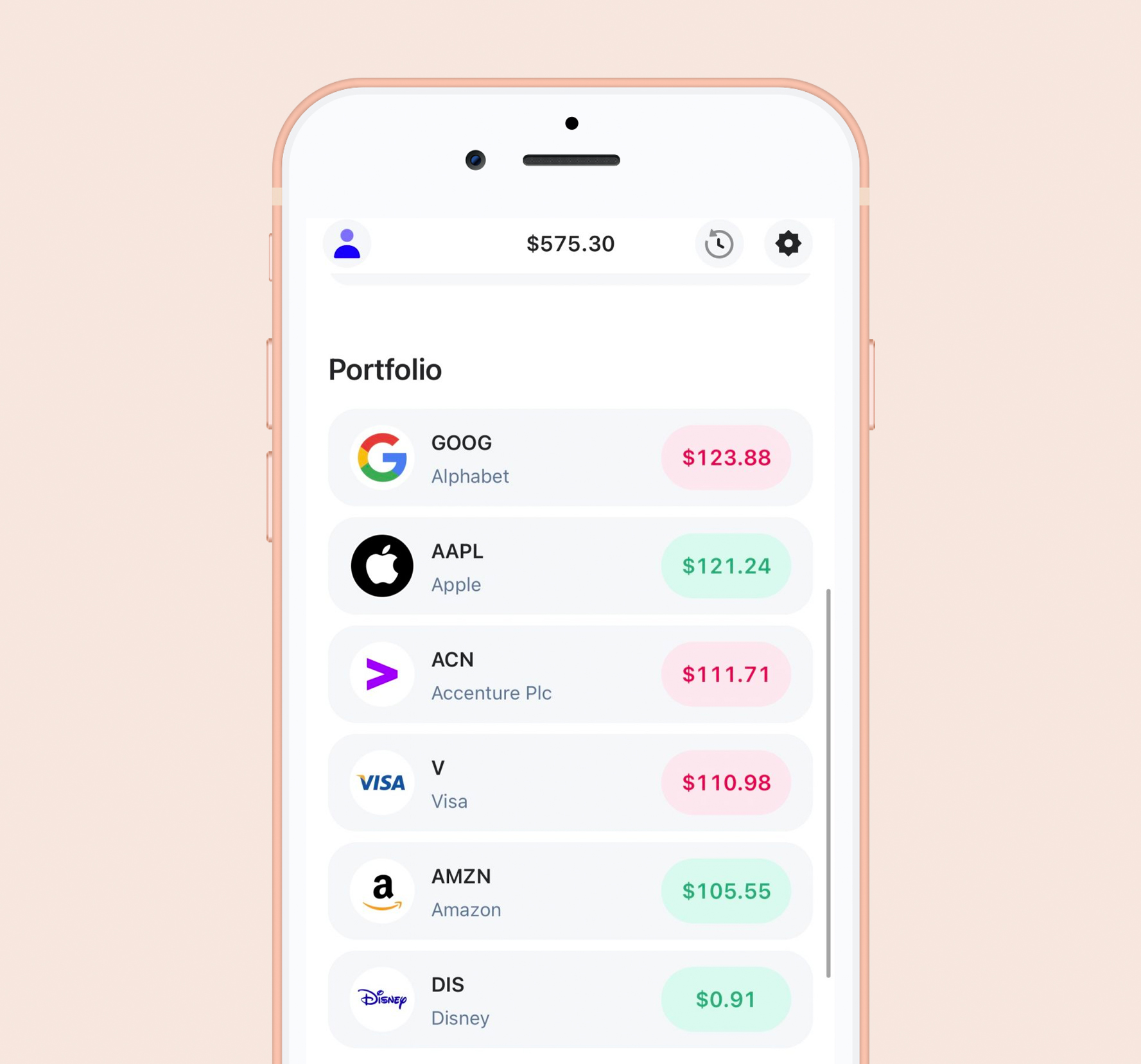

In partnership with Public, they gave me $500 to begin investing. Once I had my funds in my app, I was prompted to invest in blue-chip stocks like Google and Apple to get my portfolio built. I chose to divide my $500 between five stocks, investing $100 each in Google, Apple, Disney, Amazon, and Visa.

The process was much easier than I had anticipated. I expected to be greeted with hard-to-understand jargon, but Public helped me get my money invested in the stock market immediately, and then I could easily trade and sell my stocks from there, right in the app.

To decide what to trade, I relied on the social network part of Public to educate myself. I looked at what fellow traders were talking and excited about, which helped me understand which stocks were currently doing well without needing to have the NASDAQ ticker up on my TV all day (or have men on cable screaming about what I should invest in). I learned from real people who spoke in layman’s terms, and it helped me decide to invest in ACN (Accenture Public), something I previously had no knowledge about.

Being able to interact with other, real investors made investing something I actually looked forward to. I checked my app every day and watched my shares go up and down and began to understand why. I felt empowered, curious, and excited—three words I never thought I’d associate with my investing experience.